how much is capital gains tax on property in florida

If you sold your home for 500000 you would not pay capital gains taxes on the entire 500000. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet the following criteria.

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Most single people will fall into the 15 capital gains rate which applies to incomes between 40401 and 445850.

. Your primary residence can help you to reduce the capital gains tax that you will be subject to. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Take advantage of primary residence exclusion Your primary residence can help you to reduce the capital gains tax that you will be subject to.

Property taxes in Florida have an average effective rate of 083 in the middle of the pack nationally. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules.

Property taxes in Florida have an average effective rate of 083 in the middle of the pack nationally. For example if you bought a home 10 years ago for 200000 and sold it. You can maximize this advantage by frequently moving homes.

Even further heirs and beneficiaries in Florida do not pay income tax on any monies received from an estate because inherited property does not count as income for Federal income tax purposes and Florida does not have a separate income tax. Long-term capital gains tax is a tax applied to assets held for more than a year. Ncome up to 40400 single80800 married.

Any profit over this amount will be taxed at the lower capital gains tax rate you see above. Residents living in the state of Florida though there are those who can see a long-term capital gains tax. Income over 445850501600 married.

But its important to understand the rules when it comes to reporting taxes and keeping your. The amount that can be excluded stands at 250000 for an individual and 500000 for a married couple. You would only pay the tax on the profit on your home if its above a specific amount.

Florida Property Taxes Go To Different State 177300 Avg. Individuals and families must pay the following capital gains taxes. Capital Gains Tax Rate.

Tax rates for short-term gains in 2020 are. Topics also include what are capital gains and capital losses real estate capital gains tax rates how to avoid capital gains tax on a rental property and much more. Three Types of Taxes Relating to Florida Real.

How much can you inherit before you are taxed. Benefiting from the 1031 exchange. You have lived in the home.

It depends on how long you owned and lived in the home before the sale and how much profit you made. The long-term capital gains tax rates are 0 percent 15 percent and 20 percent depending on your income. Income over 40400 single80800 married.

Head of household over. They may owe an additional. Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year.

As a very basic example if a seller spent 50000 to build their business and sold it for 70000 its possible that Capital Gains taxes may. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. The Golden State also has a.

Many home sellers dont have to report the sale to the IRS. Single filers with incomes more than 445851 will get hit with a 20 long-term. There is a progressive income tax with rates ranging from 1 to 133 which are the same tax rates that apply to capital gains.

097 of home value Tax amount varies by county The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Capital gains tax rates on most assets held for a. If you make a profit on the property in an amount more than the depreciated value regardless of whether you claimed it you must pay depreciation recapture tax at a rate of 25 on that overage amount.

The estate tax is a tax on a persons assets after. It lets you exclude capital gains up to 250000 up to 500000 if filing jointly. How long you own a rental property and your taxable income will determine your capital gains tax rate.

Short-term investments held for one year or less are taxed at your ordinary income tax rate. These rates are typically much lower than the ordinary income tax rate. 500000 of capital gains on real estate if youre married and filing jointly.

When a seller sells a business in Orlando or any other area Capital Gains taxes are applied to the actual profit made upon the sale of the business and not the equity that was put in to the business. You have lived in the home as your principal residence for two out of the last five years. For assets held less than one year short-term gains are taxed at regular income rates which may be as high as 34 based on the taxpayers individual income.

The States With The Highest Capital Gains Tax Rates The Motley Fool

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax In The United States Wikiwand

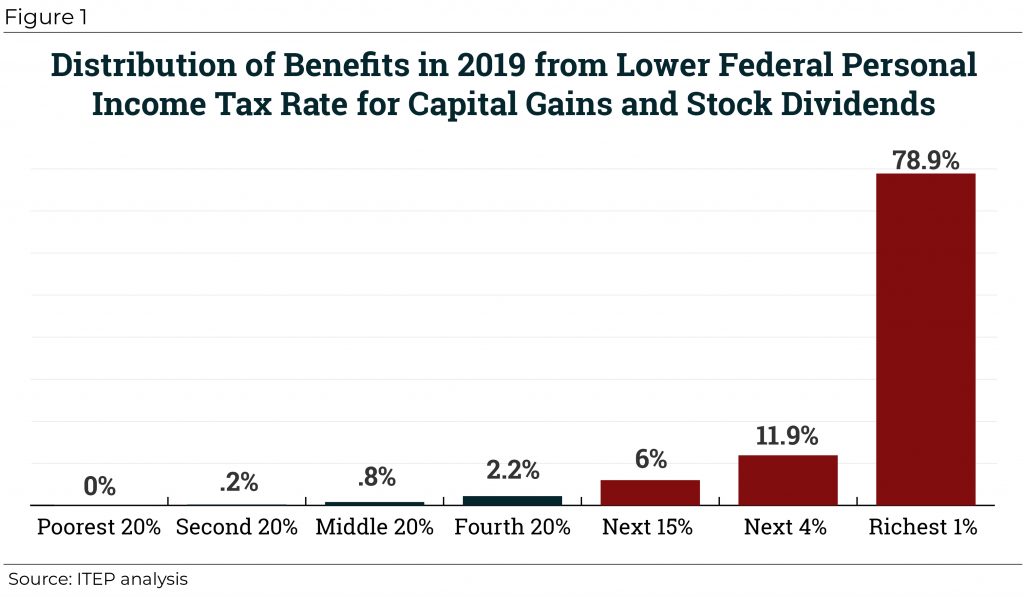

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

How Much Is Capital Gains Tax On Real Estate Plus How To Avoid It

Florida Real Estate Taxes What You Need To Know

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

The Capital Gains Tax And Your Palm Beach Area Property Rabideau Klein

How Much Tax Will I Pay If I Flip A House New Silver

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

How High Are Capital Gains Taxes In Your State Tax Foundation

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Pin By Louanne Sander On Real Estate In 2021 Things To Know Capital Gains Tax Florida

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube